Frequently Asked Questions (FAQ)

-

Who is Monaxa?

Definition of Monaxa: combination of "money" and "axis". Reminiscent of "mon axer", meaning "my orientation point".

Monaxa is a forex broker offering frictionless trading environments using technology already trusted by millions. It is a single point of access to the global markets in which clients can invest and trade thousands of assets with us.

We aim to become as frictionless as possible. Simple registration flows. Intuitive site navigation. Robust trading options. Reliable funding and withdrawal methods. Frictionless trading was worth waiting for.

-

Why choose Monaxa?

• We offer thousands of trading instruments. Your clients can trade what, when and how they want.

• We offer trusted trading machines. Powerful enough for the professional yet intuitive enough for the novice.

• We designed very diverse account types. Built to match your clients' needs and structured to match their goals.

• We will work hard to be your frictionless partner. Forming a long-lasting relationship benefiting the client, you and us, in that order.

-

Where are your offices?

Monaxa has a main office in St. Vincent and the Grenadines. The legal entity and jurisdiction are regulated by the relevant regulatory body in that country. Address: First Floor, First St Vincent Bank Ltd Building, James Street Kingstown, St. Vincent and the Grenadines

-

Who are your regulators?

Monaxa Ltd (“the Company”) is an entity incorporated under the Business Companies (Amendment and Consolidation) Act, Chapter 149 of the Revised Laws of Saint Vincent and the Grenadines, 2009, with the following registrations: Company Number 26883 BC 2022.

-

Do you have any social media accounts?

-

How does Monaxa use my personal information?

At Monaxa, we prioritize the protection of your personal information and only collect data that is necessary for the provision of high-quality products or services, as well as for the purpose of complying with legal and regulatory requirements and preventing fraud.

Our Privacy Policy outlines how we handle our customers’ personal information.

-

How do I register?

To register the account, kindly click Sign Up at the top right-hand corner of the website. The registration form will first prompt you to enter all necessary account information. Once you finish your registration, an e-mail verification will be sent to your email.

The email confirms your successful registration and will prompt you to activate your Monaxa Portal by clicking the link provided.

-

Can I open more than one account?

It is not possible to register more than one profile per client.

-

Can I use the same email address for more than one account?

It is not permitted to use the same email address for multiple profiles. Please be aware that Monaxa allows only one profile per client.

-

How to verify my account?

To ensure the accuracy and reliability of our verification process, Monaxa utilizes an integrated Artificial Intelligence system known as Sumsub to verify and validate the Proof of Identity and Proof of Address of our clients.

To complete verification after registration, the client must do as below;

Profile > Verification > Phone Verification > ID Verification > Selfie

-

What supporting documents do I need to provide?

• You are required to provide an identity document (ID card, Driver's license, Passport) for visual scanning.

• Kindly ensure that it is not expired or physically damaged.

• The ID document must contain:

Full Name:

Date of Birth

Valid Expiry Date

Front and Backside• All images should be high resolution and the above details must be clearly readable.

-

How long does it take to verify my account?

Our standard check normally takes about 5 - 10 minutes, in case of difficulties it may take up to 24 hours.

During this period if you still don’t receive a reply, you may contact our support team through Live Chat or send follow up requests via Help Desk ticket from Monaxa portal > Profile > Help Desk > Add New Ticket. The direct link is here

-

How do I know if my account has been verified?

You will see “Your profile is verified” status in your Monaxa Portal under the Profile tab.

-

What happen if I consistently upload incorrect documents?

Kindly be informed, during the check you have 5 attempts to upload correct documents or provide relevant data. Otherwise, you will not be able to pass verification.

If you have uploaded incorrect documents 5 times, or you have some question about the check, feel free to contact us through Live Chat or send us a ticket from your Monaxa portal > Profile > Help Desk > Add New Ticket. The direct link is here

-

Can I change my personal information?

You may change your personal information under the Profile tab in the Monaxa portal. The direct link is here

-

What is the password requirement for registration?

The password must be at least 5 characters long.

-

What is the password requirement to change the Monaxa portal password?

Must contain at least 1 upper case latin letter, 1 lower case latin letter and be at least 5 characters long

-

Can I change my registered email address?

Yes, you can. To change your registered email address, follow these steps:

1. Log in to your Monaxa portal account.

2. Go to the "Profile" section.

3. Under the "Email" tab, click "Change."

4. Click "Continue" under "Send PIN via email."

5. Enter your new email address and specify the reason for changing it.

6. Enter the PIN that was sent to your email.

7. Click "Continue" to finalize the email change.Note: These instructions assume that you have access to your registered email address and are able to log in to your Monaxa portal account. If you are unable to access your registered email address or log in to your account, you may need to contact us via enquiry form here

-

How do I access my Monaxa portal?

-

How do I see my live account details?

You may see your live account details in your Monaxa portal under Accounts > Accounts Overview > View.

-

How do I reset my Monaxa portal password?

You may reset your password in your Monaxa portal under Profile tab > Profile > Profile Information > Password > Click Change. The direct link is here

-

What types of accounts does Monaxa offer?

Monaxa offers three types of accounts: Standard, Pro, and Zero.

Each type of account may have different features and fees associated with it, so it is important to choose the account that best meets your needs. For more information, click here

-

How to create a live trading account?

You may create your live trading account in your Monaxa portal under Accounts tab > Open Live Account. The direct link is here

-

Can I create more than one live trading account?

Yes, you can have a maximum of 5 accounts on each account type.

-

How long does it take to open a trading account?

It takes less than 1 minute for you to open a trading account and start trading with Monaxa

-

Where can I reset my cTrader ID password?

You may reset your cTrader password using this link

https://id-app.monaxa.com/reset

Kindly note that the new password must be at least 5 characters long.

-

Can I change my trading account type?

No, you cannot change your account type. If you wish to have a different account type, you may create additional account by following the link -

-

What base currencies can I open an account in?

Our current available base currencies are as follows:

Standard – USD, EUR, GBP.

Pro – USD, EUR, GBP.

Zero – USD, EUR, GBP. -

Are there any fees or commission on trades?

It depends on the type of trading account you created. For more information regarding fees and commissions please click this link:

-

Can I change the base currency of my account?

No, base currency cannot be changed after a trading account is created

-

Will my account get archived if I have zero balance on it?

Trading accounts with zero balance are archived after a period of 90 calendar days. Kindly note that once a trading account gets archived, it can’t be reopened. In case you only have an archived account and no active accounts to trade on, you need to register for a new trading account.

-

Is there a dormant fee if I don’t use my account?

Yes, trading accounts with no activity on them from the last 90 days will be archived. If there is no activity or trade during a ninety (90) day period, we will deduct 3.00 USD and the next deduction of 3.00 USD after 30 days of inactivity. If the balance is less than $3, the full amount of free remaining balance will be deducted.

-

What is cTrader?

cTrader is a platform with advanced trading capabilities such as fast entry and execution and coding customization designed by Spotware Systems.

-

How do I download the cTrader platform?

-

What is a cTID and how can I log in to my cTrader platform using one?

You may see your cTID details from the email with the subject “Welcome to cTrader ID”.

Your cTID is based on your registered email address.

Example: Your registered email address is [email protected], you can login to your cTrader platform using cTID: starrynight@ gmail.com OR starrynight.

Please note that each cTrader user has their own unique cTID, which is a set of login details used to access the trading platform. All cTrader trading accounts are linked to just one cTID (if you open using the same registered email address). If you open an additional cTrader account, it will be automatically linked to your cTID and you will see it the next time you log in to the platform.

-

Why can't I login to my cTrader platform?

Please note that if this is your first time login, you need to generate the cTrader password first. You can get the link to generate your password in the email subject “Welcome to cTrader ID”.

If you already generated your password before, and are unable to login, please try reset your cTrader password.

-

How can I reset my cTrader ID password?

You may reset your cTrader password using this link

https://id-app.monaxa.com/reset

-

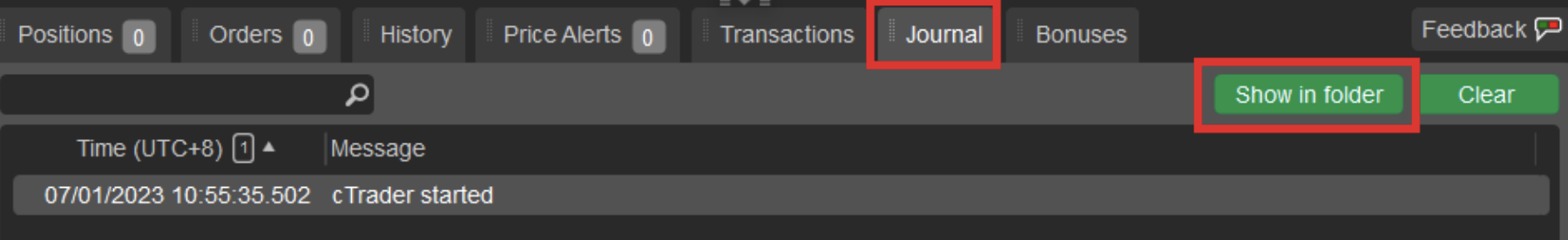

How do I retrieve my journal log?

To retrieve the journal logs in cTrader, simply click on the Journal tab and then select the Show in Folder button. The folder containing your log files will then appear.

-

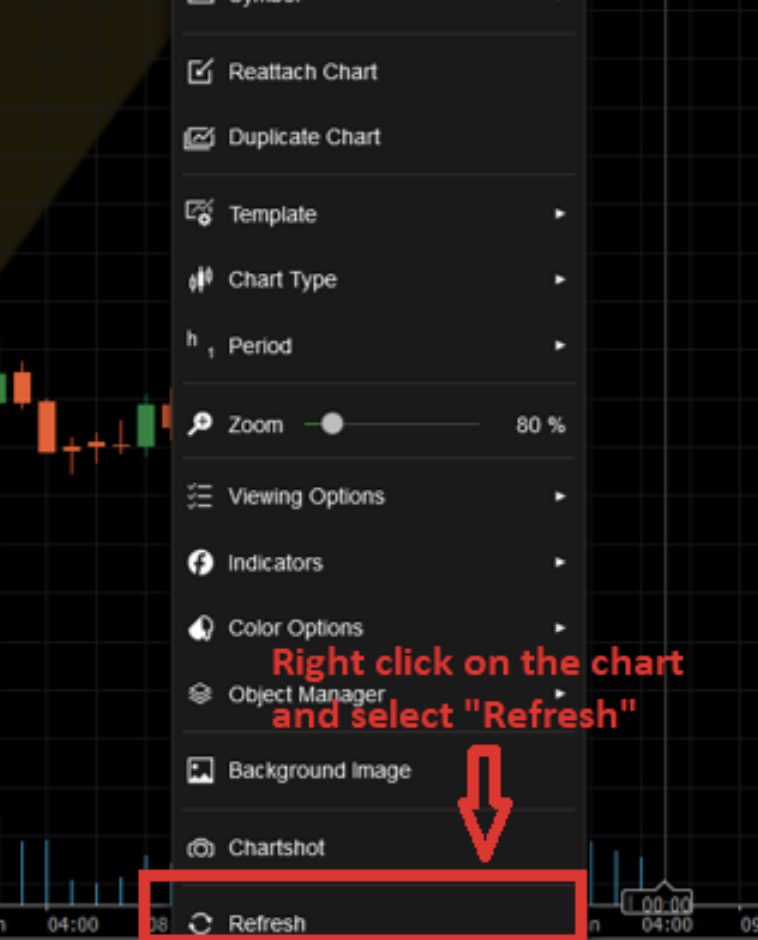

How do I refresh my chart data?

Right-click on the chart and select ‘Refresh’.

-

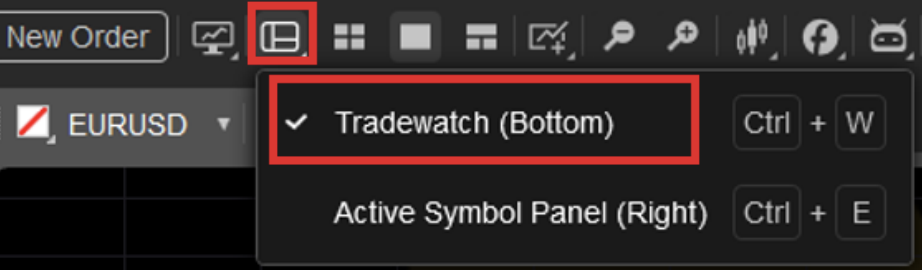

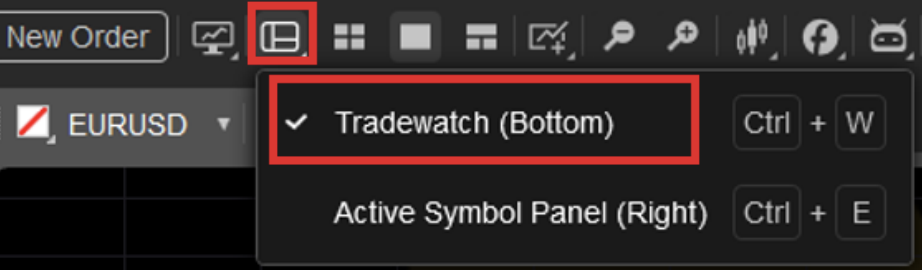

Where can I find my account balance and trade history for cTrader platform?

Your account balance and trade history can be found in the ‘Trade Watch’ window at the bottom of your cTrader screen. If the Trade Watch is hidden, you can enable it in the Layouts. Click the Layout button in the Account bar and select Show ‘Tradewatch’ from the drop-down.

-

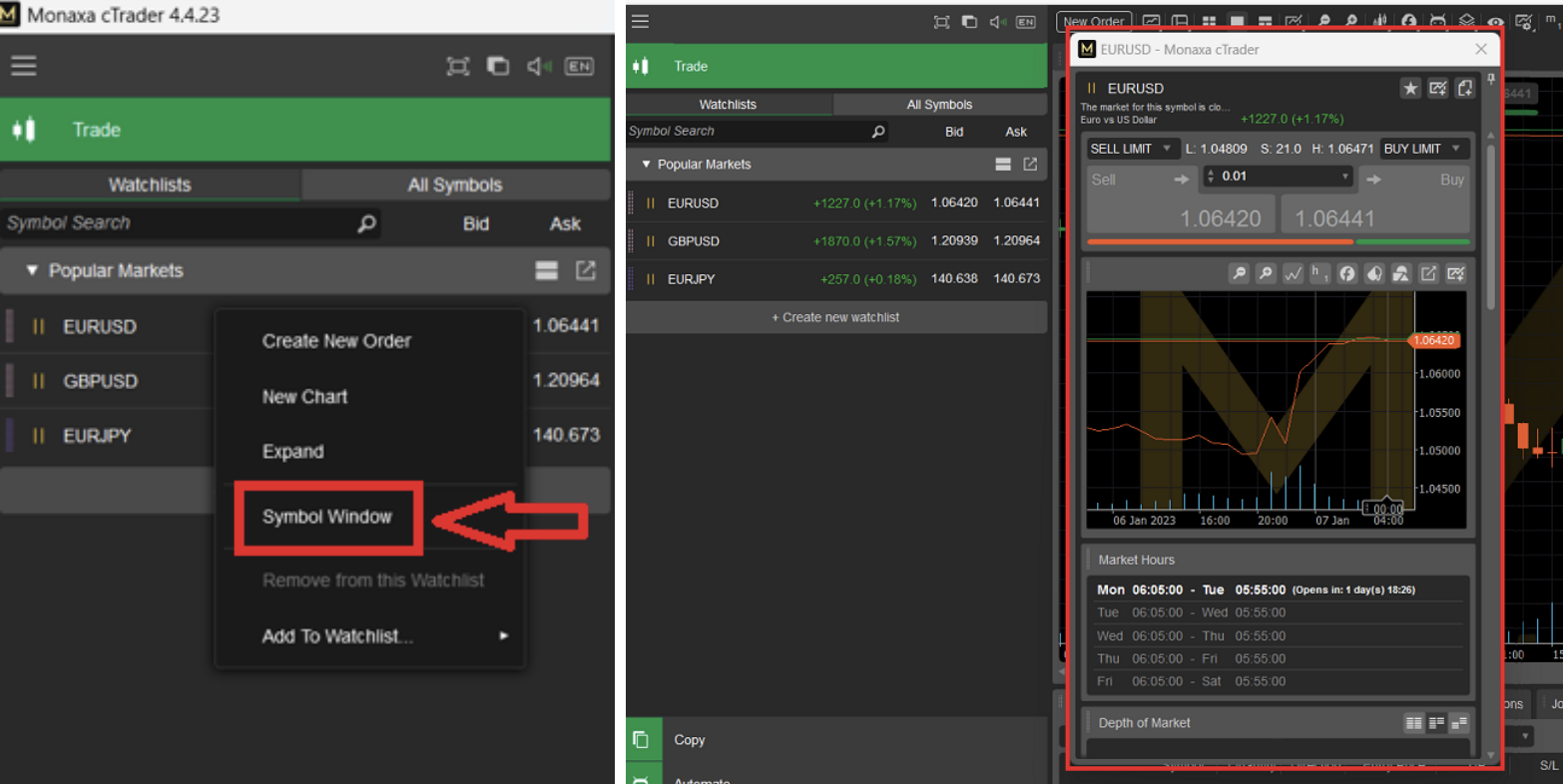

Where do I find information regarding each instrument?

You can find pair-specific information simply by right click on a pair in the ‘Watchlists’ window, select ‘Symbol Window’, and all relevant information for that pair will appear in a popup window.

It also can be found in the ‘Active Symbol Panel’ window at the right of your cTrader screen. If the ‘Active Symbol Panel’ is hidden, you can enable it in the Layout button and select Show ‘Active Symbol Panel’ from the drop-down.

-

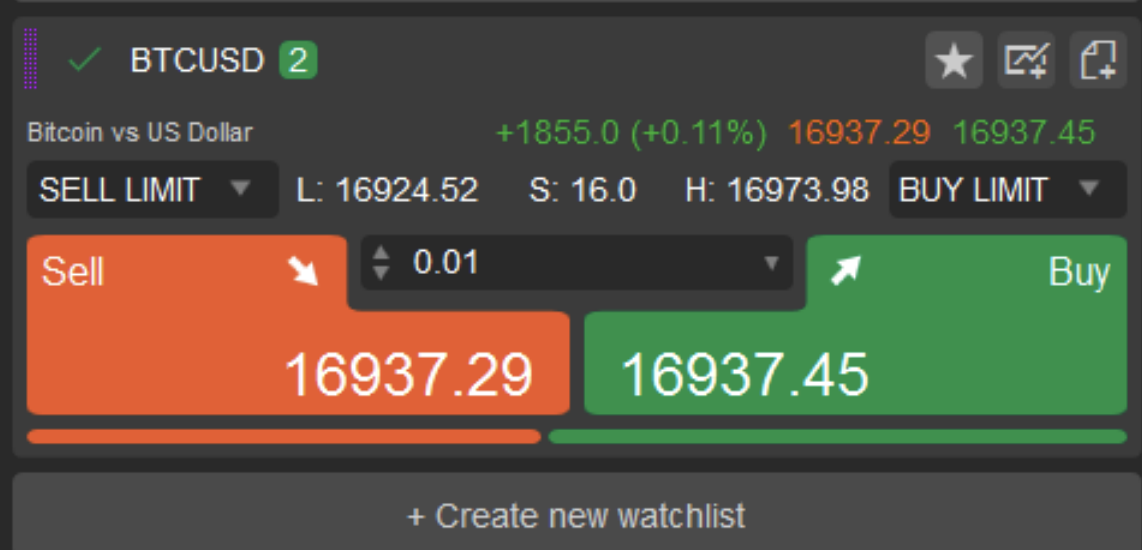

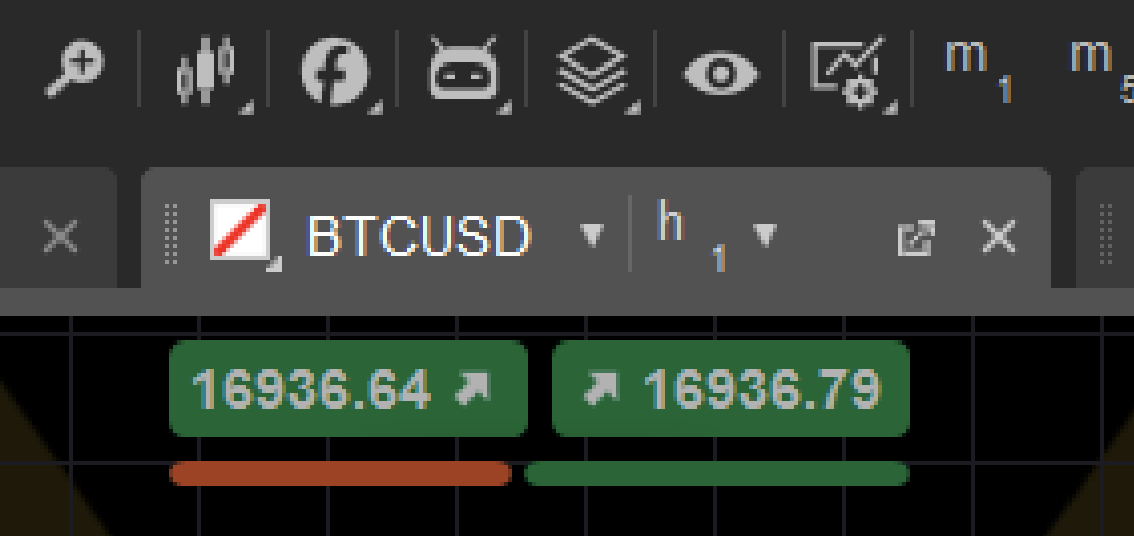

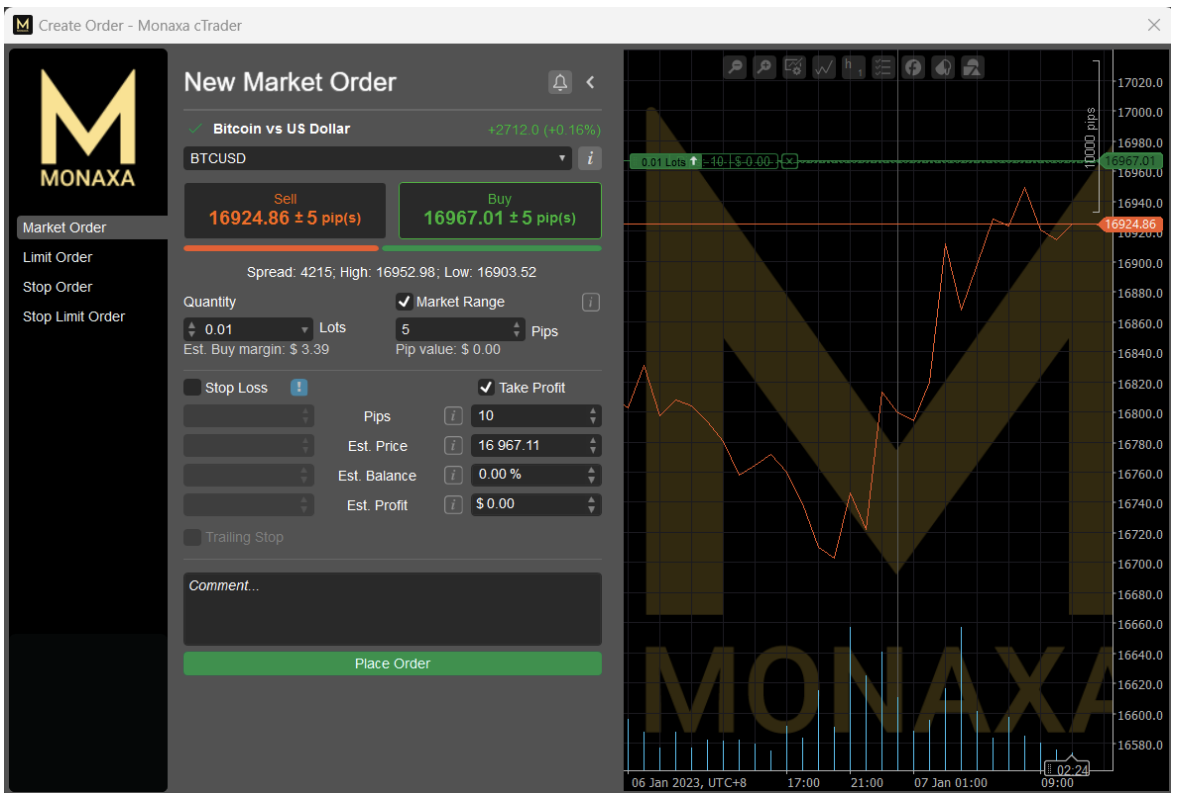

How do I create a new order in cTrader?

There are several ways to create a new order in cTrader

You can click on the icon above the watchlist on the left-hand side of the platform. You can also click on any instrument in the 'Watchlists' select the ‘New Order’ icon, or place an order directly from the Buy and Sell buttons:

The buy and sell buttons are also available on any chart you have open:

If you do not have 'QuickTrade' settings enabled, a new window will appear which will allow you to create a new market order, limit order or stop order, to select the instrument you wish to trade and to set stop-loss and take-profit levels:

Note: If you wish to open and close trades with single or double click, directly from the charts and watchlist, you will need to set this up in the settings.

-

How do I modify or delete a pending order in cTrader?

Should the need arise for you to modify or delete a pending order that you have placed, click on the ‘Orders’ tab in the ‘Trade Watch’ window. This will bring up all your pending orders. Right-click on the order you wish to modify or delete, to be given the option to either modify or cancel the order. If you click on ‘Modify’, a new window will appear that will allow you to change the parameters of your pending order. If you click on ‘Cancel’, your order will be automatically removed from the list.

-

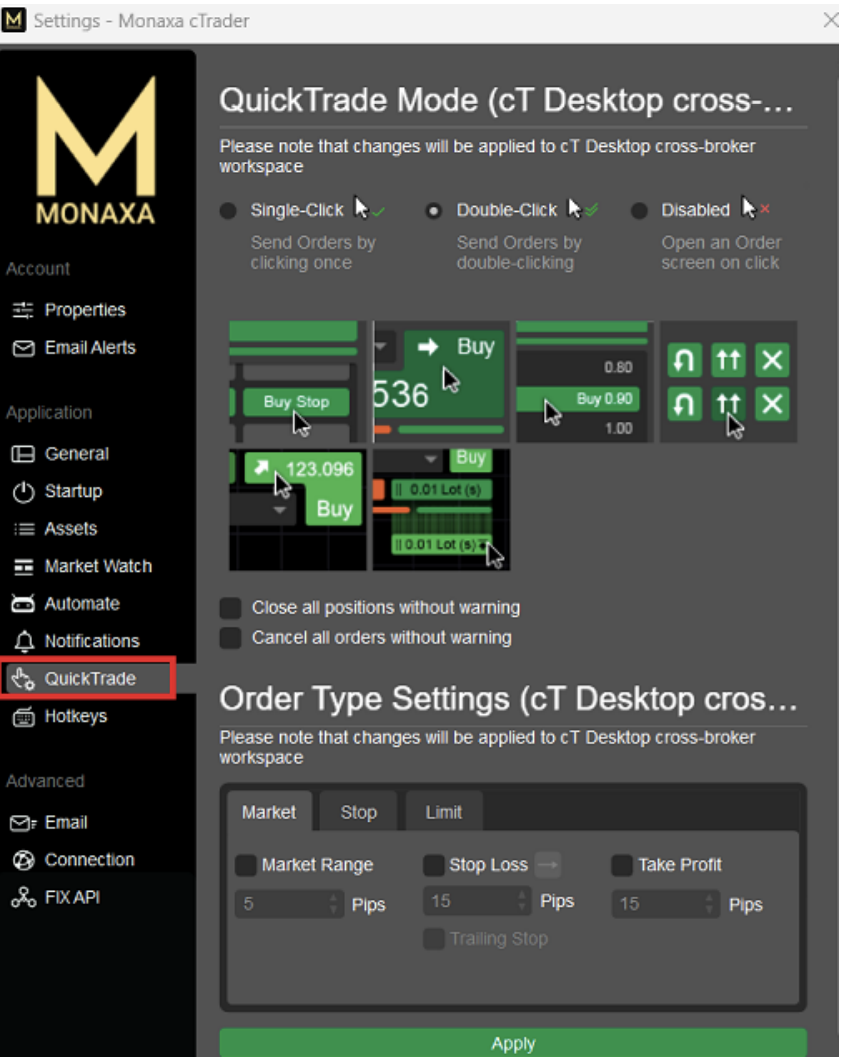

How can I set up single click or double click trading?

On the cTrader platform, click on the settings icon in the bottom left-hand corner, and select the 'QuickTrade' tab. From here you can select if you would like 'single-click' or 'double-click' trading.

If you have the quick trade settings 'Disabled', it means that you will have a pop-up box to confirm any trade actions.

You are also able to set up default SL/TP and market range settings for all order types from this window.

-

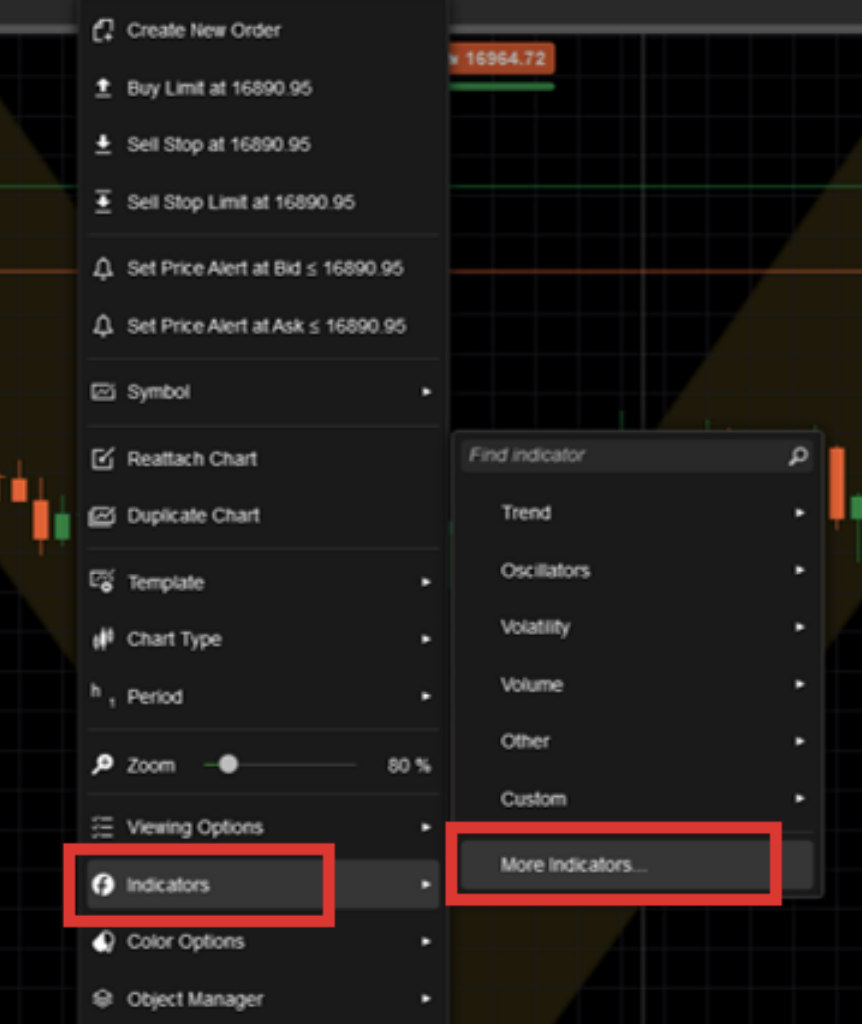

How can I download a cBots or custom indicator on cTrader?

You are able to download additional indicators/cBots via the cTDN website:

Indicators: https://ctdn.com/algos/indicators

cBots: https://ctdn.com/algos/cbotsP

You can also click on the indicator icon on any cTrader chart and select 'more indicators'.

When you click to download from the website, it will prompt you to automatically install it to the cTrader platform.

-

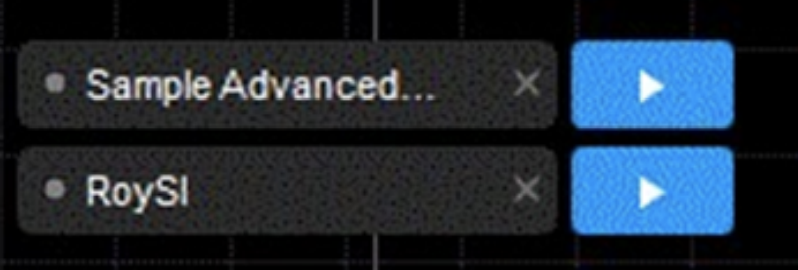

How do I know whether my cBot is running correctly?

If you are running cBots on your cTrader platform, you will be able to see a list of attached cBots on the bottom left corner of the chart. A ‘Stop’ button will also appear if your cBot is running correctly.

If you are running cBots in the 'Automate' tab, you will be able to see a list of active instances under each cBot in the cBots list. A ‘Stop’ button will also appear next to running instances. Once your cBot is running, you can check the ‘Journal’ and the ‘cBot Log’ tabs to see if your system is reporting any errors.

-

Can I test my cBot before going live?

Yes, you can back-test the performance of your cBot over historical data on the cTrader platform. To do this, you need to navigate to your 'Automate' section of the platform, click on the arrow next to your cBot, and select 'Add an Instance'.

-

Can I run more than one cBot at the same time?

Yes, you may run multiple cBots at the same time and on the same chart. Once you add them to the chart, you will see a separate box for each in the bottom left hand corner of the chart.

-

How do I stop a cBot that I have loaded on my cTrader platform?

To remove a cBot from cTrader, click on the ‘Stop’ button. Instances can be removed from the chart in cTrader or from the ‘Instances’ list in the 'Automate' tab.

-

Will my cBot continue to work after I close the cTrader platform?

In order for your cBots to trade for you, your machine must be running with your cTrader terminal open. Closing your cTrader terminal will cause your cBots to stop trading. You may need to subscribe to VPS (Virtual Private Server) to have your cBots continue to trade around the clock, regardless of whether your cTrader terminal is open or your computer running.

-

What trading account types and contract size do you offer?

STANDARD: 1 standard lot is 100,000 units of the base currency

PRO: 1 standard lot is 100,000 units of the base currency

ZERO: 1 standard lot is 100,000 units of the base currency -

How many MT4 live accounts can be opened at the same time?

Clients may open up to 5 trading accounts for each account type.

-

I have reached my maximum limit to open a new account, how can I proceed?

Clients may send an email to [email protected] or send us a help desk ticket for the request here

-

What base currencies does the account support?

We support USD, EUR, and GBP currency at the moment.

-

Do you offer Swap-free/Islamic accounts?

We do provide swap-free accounts, catering to the needs of our clients who follow Islamic principles. Eligible individuals may apply for this account type, by providing relevant documents issued by the government or local Islamic Council.

-

How to open a demo account?

You can quickly download the MT4 application trading platform here:

https://www.monaxa.com/en/platforms/#metatrader-4/Once you register with us, click “Open Demo Account” in your personal area and choose account preference. Credentials will be ready at the next page.

-

Is there an expiration date for the demo account?

Your account will expire within 30 days of inactivity.

-

What type of trading product do you offer?

We offer CFD trading on a wide array of different asset classes such as Forex, Precious Metals, Indices, Energies, Global Stocks, Cryptocurrencies & Investment Baskets.

-

How do I change MT4 Main/Investor Password?

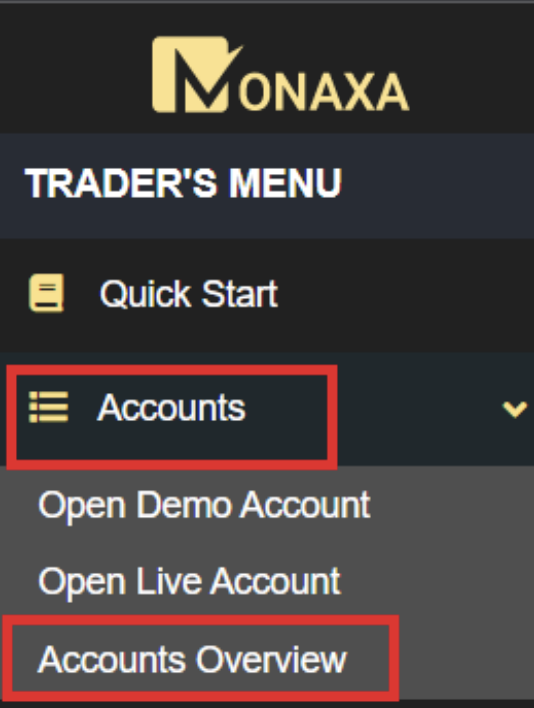

From your secure area, go to

Home > TRADER'S MENU > Accounts > Accounts Overview

Next, choose your account and click “Change”. -

How do I update my personal information?

Go to your secure area, go to

Home > TRADER'S MENU > Profile > Profile.

Here, you may edit login password, email, phone number, notification preferences and language. -

Is MacOS MT4 version available for MT4?

Not at the moment.

-

How do I login MT4 on my Mobile devices?

You need to download the MetaTrader4 application from App Store or Google Play Store first, search for Monaxa-Live to add the server, and then enter your MT4 account and password to log in.

-

There is a message showing "Account is invalid" or "Authorization failed" during login. Why is that?

Most probably the password or MT4 number being put incorrectly. Please chat with our live agent to reset the password.

-

What is forex?

The foreign exchange market, which is known as “forex” or “FX” is the largest financial market in the world. Quite simply, it is the global financial market that allows one to trade currencies.

-

What is a lot?

A “lot” is a unit measuring a transaction amount. When you place orders on your trading platform, orders are placed in sizes quoted in lots.

Standard size for a lot is 100,000 units of currency and now there are also mini, micro and nano lot sizes that are 10,000, 1,000, and 100 units.

-

What are major currencies?

A “lot” is a unit measuring a transaction amount. When you place orders on your trading platform, orders are placed in sizes quoted in lots.

They’re called “major currencies” because they’re the most heavily traded currencies and represent some of the world’s largest economies. Example: USD, EUR, , GBP, CHF pairs, another is AUD, NZD, and CAD.

-

What are cross-currency pairs?

Currency pairs that don’t contain the U.S. dollar (USD) are known as cross-currency pairs or simply as the “crosses.” Major crosses are also known as “minors.” The most actively traded crosses are derived from the three major non-USD currencies: EUR, JPY, and GBP

-

What are exotic currency pairs?

Exotic currency pairs consist of one major currency and one currency from an emerging market. A few examples are USD/SGD and USD/BRL.

-

What is the currency future?

A currency future is a contract that details the price at which a currency could be bought or sold, and sets a specific date for the exchange.

-

What is a pip?

A pip is the smallest whole unit price move than an exchange rate can make, based on forex market convention.

Most currency pairs are priced out to four decimal places and a single pip is in the last (fourth) decimal place.

-

What is a demo account?

Having a demo account means the following:

You will trade on the live market. It is for free, and you can use it as long as you want. It simulates real trading conditions but does not expose you to risk. You trade with virtual currency – with no danger of losing real money.

-

How can I create a demo account?

Start trading and create your demo account by clicking here

You will trade on the live market. It is for free, and you can use it as long as you want. It simulates real trading conditions but does not expose you to risk. You trade with virtual currency – with no danger of losing real money.

-

Can I create more than one demo account?

It is possible to create multiple demo accounts, with no limit on the number you can create.

-

Can I increase or decrease my demo account balance?

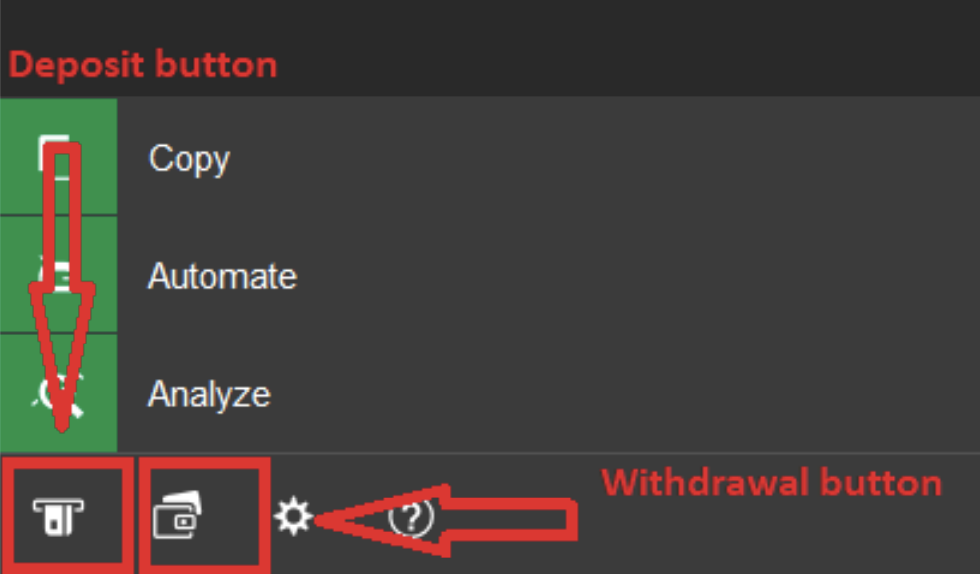

Yes, you may do so from the Monaxa portal and cTrader platform. Just click Deposit and Withdrawal to update your demo account balance.

-

What trading platforms can I trade with?

Monaxa offers cTrader as a trading platform of choice. You can download our cTrader desktop platform here

-

Will my account get archives if I have zero balance on it?

Trading accounts with zero balance are archived after a period of 90 calendar days. Kindly note that once a trading account gets archived, it can’t be reopened. In case you only have an archived account and no active accounts to trade on, you need to register for a new trading account.

-

Do you provide MetaTrader 5 platform as well?

Not at the moment, however we are working to include MetaTrader 5 as one of our trading platforms.

-

Why does my platform keep freezing?

Platform freezing is common if there is an increased influx in the amount of data reaching your terminal. Make sure you are on a dedicated high-speed network connection.

-

What instruments can I trade?

You may trade all the instruments offered by Monaxa. For more information regarding our instruments please follow the link -

-

What is Spread?

Spread is the difference between Bid and Ask price when exchanging or trading instruments. Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions.

-

What are fixed spreads?

Fixed spreads are set by the broker and don't change regardless of market conditions or volatility. The spread you are offered is the spread you pay.

-

What are floating spreads?

Spread is the difference between Ask and Bid prices that may vary depending on the market situation. Floating spread reflects the prices of the trading instruments and how quickly they are changing. Floating spread may have a range that is lower than typical when the market is quiet and liquidity is high.

-

Why is there a commission charge to my account

On the Monaxa Zero account type, spreads on FX & Metals are very low (as low as 0) without any mark-up, and there is a commission of $6 charged per round turn lot.

All other instruments on the above account types are with floating spread and zero commission. -

What is swap?

Swap refers to the interest that you either earn or pay for a trade that you keep open overnight. There are two types of swaps:

Swap long (used for keeping long/buy positions overnight)

Swap short (used for keeping short/sell positions overnight).

-

Why is there a swap fee?

A swap, also known as “rollover fee”, is charged when you keep a position open overnight. A swap is the interest rate differential between the two currencies of the pair you are trading. It is calculated according to whether your position is long or short. You may earn or pay on positions held overnight on the Forex market.

-

Why is there a triple swap rate?

If you hold an open position over Wednesday night, the amount added or subtracted to your account because of the swap rate charged is three times the usual amount. Triple swap rates are charged in the roll-over period on Wednesday night to account for the settlement of trades over the weekend where no swap rates are charged due to the market being closed. Please note this comes into effect regardless of whether your trade was open during the weekend.

-

Why is there a daily fee?

Daily fee is charged to Islamic account which has an open trades position overnight for more than the grace period set. This daily fee will be based on the swap rates.

-

Do you offer Islamic accounts?

Yes, all accounts are swap free by default except for Zero account type.

-

What is leverage?

One of the main attractions of trading CFDs. The higher the leverage, the larger position a trader can build up and control using the initial margin requirement. However, the increased opportunity brings increased risk.

To calculate normal margin-based leverage, divide the total transaction value by the amount of margin:

For example: trade $100,000 as one standard lot of EUR/USD with a required deposit of $1,000 as a 1% margin and your margin-based leverage is 100:1 (100,000/1,000). For a margin requirement of just 0.25%, the margin-based leverage will be 400:1, using the same formula.

-

What is dynamic leverage?

Dynamic Leverage is a mechanism that changes the amount of margin required/used margin for new trades dynamically for clients to manage their exposure better in real-time, without affecting margin on any previous trades. For more information, kindly click here

-

What leverage can I trade with Monaxa?

Monaxa offer dynamic leverage up to 1:4000.

-

What are the margin requirements?

Margin refers to the funds required to open a trade and maintain it.

The initial margin requirements for a trade are dependent on:

-Trading account leverage

-Size of the trade

-The instrument

-The instrument

-Account base currency

-

What is the definition of Free Margin?

Free margin is the money in a trading account that is available for trading.

To calculate Free Margin, you must subtract the margin if your open positions from your Equity (i.e., your Balance plus or minus any profit/loss from open positions).

Example

If someone with a Balance of $10,000 were to buy 2 lots of EURUSD at the exchange rate of 1.20000, he would need $240,000 ($200,000 X 1.20000).His required margin for this position would be 240,000/50 = $4800.

Now let’s say that the price of EURUSD drops to 1.19050 after he entered the trade. This would mean that he incurred a loss of 0.00950 pips (1.20000 - 1.19050), which is equivalent to $2280 ($240,000 X 0.00950).

So, using the Free Margin formula, the trader’s free margin in this case would be Equity ($10,000 - $2280) minus Margin ($4800) = $2920.

-

What is a Margin Call?

A margin call is the term used to describe the alert sent to a trader to notify them that the capital in their account has fallen below the minimum amount needed to keep a position open.

A margin call can mean that the trader must put up additional funds to balance the account, or close positions to reduce the maintenance margin required.

Margin call can also be used to describe the status of your account – i.e., you are ‘on margin call’ because the funds in your account are below the margin requirement.

When you trade with leveraged products such as CFDs, there are two types of margins:

-A deposit margin, needed to open the position

-A maintenance margin, needed to keep the position open.

**It is the failure to uphold the latter that will trigger a margin call.

If a trade starts to lose money, the funds in your account may no longer be enough to keep the position open and your provider will ask you to top up your account to bring your balance up to the minimum margin – this notification is a margin call.

If you top up your funds, the position will remain open. If not, your provider may close the position and any losses incurred will be realized.

The term margin call came from the practice of brokers calling their clients to notify them of the account deficit. But these days, most margin calls are delivered by email.

-

What is a Stop Out?

A stop out level in forex is a predefined point of 'margin level' whereby a traders' open positions will be closed, to avoid a negative account balance.

The margin level % signifies how much equity you have compared to your margin. The use of leverage plays a big role in this, as the more leverage you use, the less margin you are using to secure position(s), leaving more free equity.

This is another reason why excessive use of leverage is risky. You can potentially lose more of your equity before reaching Stop Out, effectively wiping out most of your account.

-

What is the Stop Out level?

Stop Out level is when your Margin Level falls to a specific percentage (%) level in which one or all your open positions are closed automatically (liquidated).

-

When does a margin call and stop out occur?

Our Margin call occurs when equity falls below 50% of the margin required for open trades on the account and stop out occurs when equity falls below 20% of the margin required for open trades on the account.

-

What is Monaxa model of execution?

As a multi-asset brokerage, Monaxa is committed to provide our clients with a comprehensive range of investment options. We offer direct access to our liquidity provider, with the goal of delivering a frictionless trading experience across various asset classes. Monaxa is not a dealing desk or market maker, and we are dedicated to becoming a new age broker that meets the evolving needs of our clients.

-

What is the difference between Market and Instant execution?

Instant execution: A client places an order and specifies both the volume and price. The order is processed instantly. If the order cannot be executed with the initially requested price (i.e., the price changes during the execution process), the trader receives a re-quote order that they can either accept or decline.

Market execution: A client places an order and only specifies the volume. The bid/ask price of the asset is generated during the execution process. If the price changes during the execution process, the broker does not reject the client’s request but fills the order with the current pricing. The final price is the required volume multiplied by the latest pricing available via Market Depth.

-

What can cause my positions to close automatically?

Your Stop Loss or Take Profit may have been triggered. If you no longer have enough equity in your account to support the trade's margin requirements, the automated stop-out system will start to close out your trades. If you are using an Expert Advisor, it may have sent an order to close your trade

-

Why can’t I close my position?

There's variety of reason which may have caused you’re not able to close your position:

The market may be closed

No internet connection

Logged out of your account

If you are still experiencing the same issue, please reach out to us via Live Chat or send us a ticket from your Monaxa portal > Profile > Help Desk tab.

-

Does Monaxa offer Stop and Limit Orders?

Yes. All orders can have a Stop Loss or Take Profit set when placing the trade to reduce risk or lock in a profit at a certain price point. You can also set or modify these after placing the trade. Once triggered, market orders are sent to close your trade at the next available price.

-

Can I use Expert Advisors/Cbots?

Yes, you are allowed to use Experts Advisors and cBots to execute your trades.

-

Can Monaxa teach me how to trade on my behalf?

Monaxa only provides general information regarding trading. Trading is personal and different for everyone based on their personal situation, financial objectives or needs.

We do provide general education to our clients but we do not trade on your behalf.

-

Does slippage occur on your platforms?

Slippage is part of trading and common in the forex market. It occurs at times of high volatility or low liquidity, as well as during major news announcements or during the release of important economic data.

Monaxa takes all the necessary steps to protect traders against market volatility, and our clients benefit from a highly-advanced trade management system that mitigates the risk of negative slippage and guarantees execution at the best available price.

-

What is market order?

A market order is an order to buy or sell a stock at the market’s current best available price. A market order ensures an execution, but it does not guarantee a specified price.

Market orders are optimal when the primary goal is to execute the trade immediately.

-

What is a Stop Loss order?

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. It is used to limit loss or gain in a trade. The concept can be used for short-term as well as long-term trading.

-

What is a Take Profit order?

A take-profit order is a type of limit order that specifies the exact price at which to close out an open position for a profit. If the price of the security does not reach the limit price, the take-profit does not get filled.

-

Do Stop Loss or Take Profit orders guarantee the exit price for my trade?

Stop Loss and Take Profit orders set a price point where if the selected price is met or exceeded in the market Bid or Ask price, a market order will be sent to close your trade.

-

Can my account go into a negative balance?

Your account may go to negative balance if there are slippages during high volatility market conditions (e.g., news release).

However, do note that retail clients are provided with negative balance protection; your trading account balance will be reset to zero the next time you fund your trading account.

-

Does Monaxa offer negative balance protection?

Yes, your account will be automatically reset for negative balance when you make a new deposit.

-

What is your product spread modelling?

All products are floating spreads, we offer a very competitive spread in the market, which is determined by real-time market conditions.

-

What range can I choose account leverage?

We provide leverage ranging between 1:100 to 1:1000 leverage, depending on your maximum equity. For details of leverage policy, please refer here:

https://www.monaxa.com/dynamic-leverage -

Will my leverage decrease during news events?

No, any change in leverage will be informed beforehand.

-

Why is my trading position open/closed at a different price?

This is what we call price slippage. This might happen when important economic news is released. Due to a sharp rise/fall in the market price, your order may be filled at a different rate than you requested. This is a normal market nature.

-

What is Monaxa Stop-Out level?

Stop-out level is 20%.

-

Does Monaxa allow Scalping?

Yes, in fact, all trading strategies are welcomed. For details please refer to Monaxa Liquidity Guidelines.

-

Does Monaxa allow EA plugin?

Yes

-

Does Monaxa allow Hedging?

No

-

Is it possible to lose more money than I deposited?

No, you cannot lose more than the amount you deposited. Should the slippage of a certain currency pair cause a negative balance, it will be reset automatically the next hour.

-

Is the dividend calculated for Indices and CFD stocks?

The dividend is settled according to the actual situation.

-

Does Monaxa pay for dividends on stock and indices?

Yes, it’s applied as a separate balance operation on the trading account.

-

How do I check dividend announcements on your site?

Dividend announcement will be made in the MT4 platform, under the mailbox

-

Do CFD products have any deadline for delivery?

There is no delivery schedule for CFD products, and there is no time limit for holding positions.

-

How do I check Swaps for products?

Log in to the MT4 platform to find the corresponding product. Right-click and find the specification for Swap Fee.

-

What is Monaxa Copy Trading Platform?

Monaxa Copy Trading Platform is a service that allows traders and followers to connect, share, and follow each other's trading activities. It enables users to observe, analyze, and copy from the strategies and trades of more experienced traders, often referred to as Copy Trade Masters.

-

How does Monaxa Copy Trading work?

Monaxa Copy Trading works by connecting traders and followers in a community where they can share statistics, deals, and trading activities. Copy Trade Masters' trades will be captured, which will automatically replicate these trades in Follower’s own accounts, in real-time, proportionally to their allocated funds through desired settings

-

What are the benefits of using a Copy Trading platform?

Copy Trading offers several benefits, including access to a diverse range of trading strategies, the ability to learn from experienced traders, time-saving by copying trades automatically, and the potential to diversify investments by following multiple Copy Trade Masters.

-

What is the minimum deposit required to join the platform?

The minimum deposit required to join the platform may vary depending on each Copy Trade Masters. Some Masters require a minimum balance to join, but the minimum set by the company is $100 or $15 (1500 USC).

-

Are there any fees associated with using the Copy Trading service?

Yes, there will be fees associated with using the Copy Trading platform. Common fees include spreads, management fees or performance-based fees. It's essential to review the platform's fee structure before joining.

-

How can I register and create an account on the platform?

To register, visit the platform's website, register your Profile with us, and search for the desired Master in Ratings. You will typically need to provide personal details, agree to the Terms of Use, and complete the account verification process, and finally deposit the minimum required amount. Then, click here Master Registration or Follower Registration to begin.

-

What financial instruments can I trade on the Copy Trading platform?

Commonly, you can trade forex, stocks, commodities, indices, and cryptocurrencies.

-

Can I communicate with other traders on the platform?

No, to protect the interests of both Masters/Followers and prevent potential scams outside of the platform's ecosystem, we have decided to restrict direct communication between users on the platform. Our platform aims to prioritize transparency and accountability to ensure a safe and secure Copy environment for all users.

-

What tools and features are available for analyzing traders' performance?

What tools and features are available for analyzing traders' performance?

We provide a comprehensive set of sophisticated rating tools to help you analyze Master’s performance effectively. These tools allow you to define your risk preferences and sort type of traders based on their performance in alignment with your risk appetite. Please find it through this link >> Social Trading Ratings

-

FAQs for Copy Trade Master:

-

What is a Copy Trade Master?

A Copy Trade Master is an experienced and successful trader on the Copy Trading platform. They share their trading strategies and allow followers to replicate their trades in real-time.

-

How can I become a Copy Trade Master on the platform?

To be listed in the ranking as a Copy Trade Master, clients are required to open a Copy Trade account and start trading upon making an initial deposit.

-

How are Copy Trade Masters ranked and rated on the platform?

Copy Trade Masters are often ranked and rated based on various factors, including their historical performance, profitability, risk management parameters, and total number of Followers.

-

What is the compensation structure for Copy Trade Masters?

Compensation structures can vary, but Copy Trade Masters may earn a portion of the profits generated by their Followers which is performance-based fee/management fee and referral fee to attract more Followers.

-

Can I trade using my own strategy or using Expert Advisor while being a Copy Trade Master?

Yes, as a Copy Trade Master, you can use your own trading strategy, and EA is also allowed. The platform allows you to share and execute your trades while Followers copy them automatically.

-

As a Copy Trade Master, what other access can I control?

You will have access to set minimum join balance, performance-fee percentage, set different Strategy deals and join links. You can find these settings in the Master Profile.

-

Can I set my own fees for Followers who copy my trades?

Yes, you may set fees in terms of percentage, but not exceed 50% performance-fee profit sharing. You can also set percentage allocation for your referrer.

-

What risk management guidelines should Copy Trade Masters follow?

Copy Trade Masters should follow responsible risk management practices to protect both their followers' capital and their own. This includes setting low leverage, setting appropriate stop-loss levels, diversifying trades, and avoiding excessive risk-taking.

-

As a Master, how do I receive performance-fee from Followers profit portion?

By default, associated fees will land in your Master’s account. But you will have an option to receive the amount in a separate account, please contact our Live Assist to guide you through.

-

Can I create multiple Strategies to attract different clientele?

As a Master, you have the option to generate multiple invitation links, allowing you to set unique offers for each link. This enables you to target and attract different types of clientele based on their preferences and trading requirements. By tailoring your offers to specific groups of potential Follower, this will maximize your appeal and reach on the platform.

-

What is the minimum deposit to open a Master Copy Trade account?

Minimum 1st time deposit of $100 or 10,000 USC is required to activate the Master Copy Trade account.

-

Can I edit my Strategies once I confirm it in the portal?

No. To protect both parties, we do not allow Master to edit the Strategy, especially on Performance-fee distribution. Please consult our Live Assist Agent for further assistance.

FAQs for Followers:

-

What is a Follower on the Copy Trading platform?

A Follower is a user who chooses to copy the trades of a Copy Trade Master on the platform. By following a Copy Trade Master, the Follower's account automatically replicates the Master's trades in real-time.

-

How do I find and choose a suitable Copy Trade Master to follow?

The platform provides tools to search and filter Copy Trade Masters based on various criteria such as performance, risk, trading strategy, and asset class. Assess multiple options and choose a Master whose style aligns with your goals and risk tolerance.

-

What information is available to help me evaluate Copy Trade Masters?

You can access detailed statistics of Copy Trade Masters, including historical performance, risk metrics, trading frequency, and Master’s equity over the period.

-

How can I start copying trades from a Copy Trade Master?

To begin, visit Monaxa.com, Sign Up as a client here >> https://account.monaxa.com/register and complete an account verification process. Next, search for the Strategy you wish to Copy, or use the Master invitation link to begin. You'll typically need to create an account at this stage, and finally deposit the minimum required amount to join the desired Master

-

Can I allocate different amounts to different Copy Trade Masters?

We encourage Followers to open separate Copy Trade accounts for each Copy Trade Master they choose to follow. This approach facilitates easier reporting and tracking of performance for each Master individually, allowing Followers to have a clear view of the results and outcomes from each Copy Trade relationship. By maintaining separate accounts, Followers can better manage their investments and assess the performance of different Copy Trade Masters more effectively.

-

What is the maximum number of Copy Trade Masters I can follow?

There is no maximum limit to the number of Copy Trade Masters you can follow on our platform. You have the flexibility to choose and follow as many Masters as you wish. However, we advise you to consider your account balance carefully and ensure it is sufficient to support potential trading reflections in your account. Diversifying your portfolio with multiple Masters can be beneficial, but it's essential to manage your risk effectively and allocate your funds wisely to accommodate your chosen Master's trading strategies

-

Can I stop following a Copy Trade Master at any time?

As a Follower, you have the flexibility to stop following a Copy Trade Master at any time. In your Follower Dashboard, you can click on the "Suspend" option to temporarily halt any Copy Trade activities in your account. This allows you to postpone copying trades from the specific Copy Trade Master while retaining the option to resume later if you choose to do so.

To completely terminate the Strategy, simply click on the “Unsubscribe” button, and you may choose to keep the existing position or to close them all. By providing these options, we ensure that you have full control over your Copy Trade activities, allowing you to make adjustments and decisions based on your investment preferences and risk management strategies.

-

What risk management tools are available for followers?

Followers have the authority to set the subscription's acceptable risks by choosing appropriate trading lot scaling, limiting the minimum and maximum open order, trade direction, loss threshold limit, and finally to close non-performing trade by automation. By utilizing these features, you can confidently navigate the Copy Trading journey while actively safeguarding your capital and optimizing your overall trading experience.

-

Can I communicate with Copy Trade Masters directly?

No, to protect the interests of both Masters/Followers and prevent potential scams outside of the platform's ecosystem, we have decided to restrict direct communication between users on the platform. Our platform aims to prioritize transparency and accountability to ensure a safe and secure copy environment for all users.

-

What is the minimum balance required to join Strategies?

The Minimum 1st time deposit is vary, depending on Masters’ requirement. Please refer to the Strategy summary before initiating the process. Typically, $100 or 1500 USC ($15) is required to activate the Follower Copy Trade account.

-

How do I deposit my account?

To deposit your account, go to Monaxa portal > Funds > Deposit Funds. The direct link is here

You may also click the deposit icon in cTrader which will redirect you to the deposit tab in the Monaxa portal.

-

What is the minimum and maximum deposit?

Our minimum deposits to open a new account is as follows:

Standard – USD 15 or equivalent.

Pro – USD 50 or equivalent.

Zero – USD 200 or equivalent.

After this first deposit, you may deposit a minimum of USD 15 for all account types.

Note: The minimum deposit may vary based on the deposit method used. Further information can be found via this link HERE

-

What payment method does Monaxa accept for adding funds?

We accept Local Bank transfer, Bank Wire transfers, cryptocurrency and some more methods available as per your country of residence.

Please note that you must withdraw via the same method used to fund your account

-

Where can I see my deposit status?

To check your deposit status, go to Monaxa portal > Funds > Transactions History. The direct link is here

-

How long does it take for money to deposit into my account?

We aim for deposits to be processed and reflected to your trading accounts within 5 minutes. However, this depends on the payment method chosen.

Click here to see more information on the processing times of each payment method.

-

Log in to the Monaxa portal > Funds > Deposit Funds > Choose Wire Transfer and fill out the required information. The direct link is here

The relevant banking details will appear on the screen for you to use to make a transfer to us

-

What payment options do I have to withdraw money?

You may withdraw via online banking, local depositor,international wire transfer and cryptocurrency. However, please note that you must withdraw via the same method used to fund your account following our withdrawal priority procedure.

You may refer to list of options available for withdrawalhere

-

What is the withdrawal priority procedure?

Monaxa will only process withdrawals/refunds back to the source of the original deposit where the name of the account holder should be the same as the name registered with us, according to the Withdrawal Priority Procedure below to protect all parties against fraud and minimize the possibility of money laundering and/or terrorist financing:

-Withdrawals for Cryptocurrency. Through this channel, withdrawal requests submitted, irrespective of the method of withdrawal chosen, will be processed up to the total amount deposited by this method. Once all cryptocurrency deposits have been entirely refunded, E-wallet refunds/withdrawals will be processed.

-Withdrawals for E-wallets. Once all Cryptocurrency deposits have been entirely refunded, E-wallet refunds/withdrawals will be processed.

-Withdrawals using Local Exchangers. Once all methods in 1 and 2 have been entirely refunded, Local Exchangers refunds/withdrawals will be processed.

-Other practices such as Online Bank Transfer and finally Bankwire.

Once deposits made with the above 1, 2 and 3 methods have been fully exhausted, all other methods such as Online Bank Transfer or Bank Wire will be used.

-

How long will it take for the withdrawal to reach my account?

Withdrawal requests will be processed and reflected to your account within 24 hours

-

Why did my withdrawal fail?

Please check your email registered with Monaxa as we may have tried reaching you to provide information regarding withdrawal failure.

-

Can I withdraw my money if I have an open position?

Withdrawals will only be processed on accounts with NO open positions at time of request.

-

Can I withdraw using a different method than my deposit method?

You may not withdraw with a different method than your deposit method, as per AML regulations withdrawal needs to be made to the same source of account which is used for deposit.

-

Can I transfer funds between my accounts?

Yes, you are allowed to transfer funds between your accounts.

-

What is the minimum transfer funds amount allowed?

The minimum amount of transfer funds for the first time may vary depending on the type of account you have. Here are the minimum amounts for each account type:

Standard: $15

Pro: $50

Zero: $200The minimum amount for recurring transfers is $5.

-

Can I transfer funds from my trading account to another client’s trading account?

No, you may not transfer funds to another client’s account as it goes against the AML regulation imposed on financial service institutions.

-

How do I transfer funds to my other trading account?

To transfer funds between your trading account, go to Monaxa portal > Funds > Transfer Funds. The direct link is here

-

Can I deposit money into my friend’s and relative’s account?

No, funds can only be transferred from accounts which belong to you as required by AML regulations.

-

Does Monaxa offer wallets?

Yes, we do have a Trader wallet and IB wallet.

-

Where can I register as an Introducer Broker?

Log in to Monaxa Portal > under IB Menu > Click Request Partnership. The direct link is here

-

Is there any requirement to become IB?

To become an IB, you simply need to register an account with us. Once these steps have been completed, you may begin introducing clients and earning commissions for your referrals.

-

What documents are needed to approve my IB account?

You are required to provide an identity document (ID card, Driver's license, Passport) for visual scanning.

- Kindly ensure that it is not expired or physically damaged.

- The ID document must contain:

Full Name

Date of Birth

Valid Expiry Date

Front and Backside- All images should be high resolution and the above details must be clearly readable.

-

Can I deposit money into my IB account?

You are required to provide an identity document (ID card, Driver's license, Passport) for visual scanning.

It is not possible to deposit funds directly into an IB (introducing broker) account. These accounts are intended only for storing commissions or rebates earned through the referral of clients.

-

Are there any non-rebated trades?

Trades that meet either of the following conditions will not be eligible for a rebate:

ANY closed trade with duration LESS than 2 minutes

ANY closed trade with pip change BETWEEN 1 to -1

-

Do you have an IB Certificate?

Yes, we do provide IB Certificates under certain conditions.

-

Where can I get Monaxa marketing materials

Log in to Monaxa Portal > under IB Menu > Click Marketing Tools. You may find your referral links and Banners under this tab.

-

How to I inquire about rebates and commission structure for partners?

Once you have registered and approved as our partner, our representative will contact you to provide more information regarding rebates and commission, as well as the appropriate tools to help you get started and grow with us

-

Does Monaxa offer any bonus?

Yes we do. We currently have these running bonuses:

No Deposit Bonus

• Standard account only

• One-Time Claimable

• No deposit required

• Available to new clients

• All profits earned can be withdrawn

50% Premier Bonus

• Standard account only

• Applies from first deposit & consecutive

• Available to new and existing

• All profits earned can be withdrawn

• Up to $1,000 per client

-

Is it possible to claim to withdraw the profit of the trade by using the bonus?

Profit from trading on the No Deposit Bonus $50 may be withdrawn anytime with the following requirements to be fulfilled:

Min volume requirements (Lots) = 1.00 Standard Lot

At least 3 round turn trades (open and closed position)

Only lot and position on Forex, Gold & Silver shall be considered

-

What happens to my No Deposit Bonus credit if I make any withdrawals or internal transfers?

Withdrawals or internal transfer of any amount from the balance will lead to removal of total bonus.

-

Can this bonus combine with other bonus promotions?

No Deposit Bonus $50 can be combined with any in conjunction Deposit Bonus Promotion held by the Company.

-

Do you have a trading signal?

Unfortunately, it is not currently available. However, we are always working to expand our offerings and may have it available in the future.

-

Where can I see the economic calendar?

You may visit our website and click on Trading Tools tab > Economic Calendar. Direct link is here

-

Do you have any trading tutorials?

Coming soon

-

What is Higher Margin Requirement (HMR)?

Higher Margin Requirement refers to an increased amount of margin needed to open and maintain trading positions compared to standard margin requirements.

-

How does Higher Margin Requirement affect my trading?

It may limit the number of positions you can open or require you to allocate more funds to maintain your positions, potentially affecting your trading strategy and available capital.

-

Why does Monaxa impose a Higher Margin Requirement?

Monaxa may impose Higher Margin Requirements to mitigate risks associated with certain trading instruments or market conditions, ensuring capital adequacy and client exposure to the uncertain market conditions

-

Is Higher Margin Requirement applicable to all trading instruments?

It may vary depending on the volatility, liquidity, and other factors of each trading instrument. For now, only USD-related news and instruments will be impacted by the HMR feature. Some instruments or market conditions may require higher margin levels to control risk effectively

-

How is the Margin Requirement calculated under this feature?

The Margin Requirement is typically calculated as a percentage of the total value of the trading position, taking into account factors such as leverage, volatility, and potential market movements

-

What time will the Higher Margin Requirement be applied?

HMR features will be applied 10 minutes before major impacting news and 10 minutes after.

-

How does Higher Margin Requirement impact my risk management strategy?

It encourages traders to adopt more conservative risk management strategies, such as using lower leverage, setting tighter stop-loss orders, or reducing position sizes to mitigate potential losses.

-

Can I request a review or adjustment of the Margin Requirement for my account?

Yes, you may request a review or adjustment of the Margin Requirement for your account, but it will be subject to Monaxa's policies, risk assessment, and regulatory requirements.

-

Are there any penalties or consequences for not meeting the Higher Margin Requirement?

Failure to meet the Higher Margin Requirement may result in the automatic closure of positions, margin calls, or other penalties, depending on Monaxa's terms and conditions